As usual, we would be foolish to expect our laws and regulations to always make sense or to keep up with the times.

As usual, we would be foolish to expect our laws and regulations to always make sense or to keep up with the times.

Over the years there have been significant technical challenges to all traditionally married couples in community property states that want to file separate income tax returns. What is often overlooked though is that registered domestic partners and same-sex married couples face those same reporting challenges plus additional crazy hurdles for proper tax reporting.

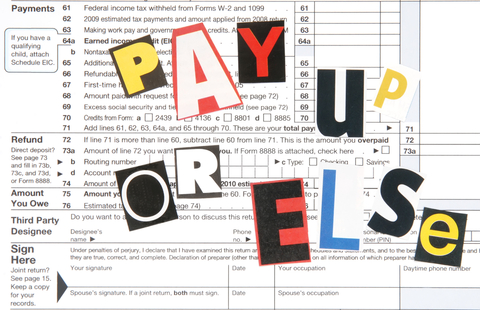

The IRS requires registered domestic partners and same-sex married couples to split their community income between their tax returns, even though they require you to file as single taxpayers (remember, we can't apply logic or common sense to any of these rules).

Because the IRS lives by computer-matching information, the IRS looks for income by the Social Security number under which it has been reported to them on information returns such as Form W-2 and Form 1099. Unfortunately, the method the IRS provides for splitting the community income between the two returns more often than not creates matching issues when the IRS looks for income reported under your Social Security number. Only half of that reported income is represented on your return; the other half is reported on your spouse or partner’s return... and it is not hard for you to figure out what comes next.

You guessed it. A not-so-nice letter from your friends at the IRS arrives asking why there is a discrepancy. When your return was prepared, a worksheet was created to show the IRS how the income was split between the two returns. Although that worksheet was included with your return, the IRS may not see it and may send you a letter asking about discrepancies.

If you're the unlucky recipient of one of these types of letters (called a CP2000 notice if you want to know the cryptic technical term), don’t be alarmed. Call your CPA (or us of course) and send them a copy of the IRS letter. They will contact the IRS and provide them with the necessary information to resolve any issues. But don't delay, you want to put the issue to rest sooner not later.

Maybe things will get better?

The IRS has released a new form to allocate tax amounts between married filing separate spouses, same-sex spouses, or registered domestic partners (RDPs) with community property rights. We are hoping that by filing returns with this form, withholding will be appropriately split and refunds will be correct. However, based on past experience, we are concerned that it will not prevent a future CP2000 problem.

The new form, Form 8958 - Allocation of Tax Amounts Between Certain Individuals in Community Property States, is now available on the IRS website. The form splits income, deductions, credits, taxes, and withholding.

Having trouble sleeping?

If you're having trouble getting to sleep at night you can download Publication 555, Community Property, from the IRS Website for your reading pleasure.

Free, No-Obligation Consultation

I would be honored to chat with you about your accounting, tax and finances whether personal or business. I offer a Free, No-Obligation consultation (at your place or mine). During our meeting we will discuss your concerns and questions and let you know how we can help you and our costs. My consultations are not just sales pitches, I will offer you some solid ideas and solutions to help you right off the bat. To schedule a consultation at a time convenient for you, call me at any of offices or call me toll-free at (888) 758-5966 or click here to email me.

I hope you found this information useful. I am excited by the fact that my practice is growing. The key to my firm’s growth — and probably your business too — is referrals from satisfied clients, customers and friends like you. If you know of a friend, colleague or business that would like to grow with us please let me know.