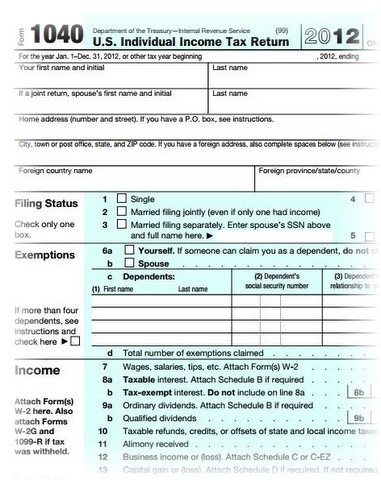

Nationally, tax preparers charge an average of $246 to prepare an itemized Form 1040 with a Schedule A and a state tax return ($288 in California), according to a survey by the National Society of Accountants.

Nationally, tax preparers charge an average of $246 to prepare an itemized Form 1040 with a Schedule A and a state tax return ($288 in California), according to a survey by the National Society of Accountants.

If a professional tax preparer can catch even one more deduction or credit that a taxpayer may have missed, that can pay for the tax prep fee, the NSA noted in its report.

The NSA collected the tax prep fee information through a biennial survey of tax preparers. The tax and accounting firms surveyed are largely owners, principals and partners of local companies who have an average of more than 26 years of experience. The survey included both Certified Public Accountants as well as non-certified preparers.

The national survey identified the average fees for preparing specific IRS tax forms as follows.

- $205 for a Form 1040 Schedule C (business)

- $556 for a Form 1065 (partnership)

- $759 for a Form 1120 (corporation)

- $717 for a Form 1120S (S corporation)

- $468 for a Form 1041 (fiduciary)

- $628 for a Form 990 (tax exempt)

- $59 for a Form 940 (Federal unemployment)

- $134 for Schedule D (gains and losses)

- $155 for Schedule E (rental)

- $185 for Schedule F (farm)

However, the fees varied considerably by region, firm size, population and economic strength of an area. The average tax preparation fee for an itemized Form 1040 with Schedule A and a state tax return in each U.S. census district were reported as follows.

- New England (CT, ME, MA, NH, RI, VT) - $237

- Middle Atlantic (NJ, NY, PA) - $258

- South Atlantic (DE, DC, FL, GA, MD, NC, SC, VA, WV) - $253

- East South Central (AL, KY, MS, TN) - $279

- West South Central (AR, LA, OK, TX) - $226

- East North Central (IL, IN, MI, OH, WI) - $225

- West North Central (IA, KS, MN, MO, NE, ND, SD) - $196

- Mountain (AZ, CO, ID, MT, NV, NM, UT, WY) - $233

- Pacific (AK, CA, HI, OR, WA) - $288

All the reported fees assume a taxpayer has gathered and organized all the necessary information beforehand. Taxpayers should make sure they provide information on time to avoid additional fees, the NSA noted. Some preparers will charge an average fee of $41 to file an extension, an average fee of $73 to expedite a return, and an average fee of $80 if information is not provided by 15 days in advance of a filing deadline.

Free, No-Obligation Consultation

I would be honored to chat with you about your accounting, tax and finances whether personal or business. I offer a Free, No-Obligation consultation (at your place or mine). During our meeting we will discuss your concerns and questions and let you know how we can help you and our costs. My consultations are not just sales pitches, I will offer you some solid ideas and solutions to help you right off the bat. To schedule a consultation at a time convenient for you, call me at any of offices or call me toll-free at (888) 758-5966 or click here to email me.

I hope you found this information useful. I am excited by the fact that my practice is growing. The key to my firm’s growth — and probably your business too — is referrals from satisfied clients, customers and friends like you. If you know of a friend, colleague or business that would like to grow with us please let me know.