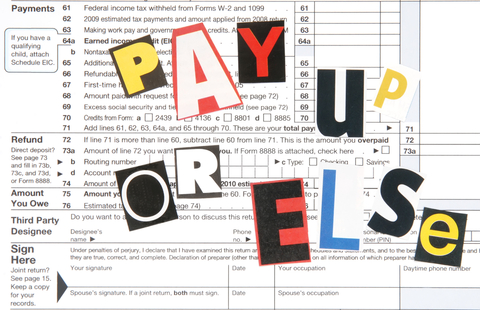

We usually try and keep these dispatches light and entertaining. We know you'd rather read about "Tax Strategies for Somali Pirates" than, say, the latest regulations governing domestic international sales corporations. But every so often it's time to put on our serious face, and this is one of those times.

We usually try and keep these dispatches light and entertaining. We know you'd rather read about "Tax Strategies for Somali Pirates" than, say, the latest regulations governing domestic international sales corporations. But every so often it's time to put on our serious face, and this is one of those times.

By now, of course, we all know that Congress spent their New Year's crafting a last-minute deal to avoid a "fiscal cliff" disaster. The "American Taxpayer Relief Act of 2012" extended the Bush tax cuts, permanently, for incomes up to $400,000 for single filers and $450,000 for joint filers. Ordinary income above those thresholds will be taxed at 39.6%; corporate dividends and long-term capital gains will be taxed at 20%. The Alternative Minimum Tax is "patched" for good, and the estate tax is eliminated for estates under $5 million.

If your income isn't quite that high, you may think you've just dodged a bullet. But the sad reality is, you're probably already paying more tax, even if your income is nowhere near $400,000:

it comes to audits, our friends at the IRS are interested in examining returns as accurately as possible. (No, they're not just interested in squeezing out more tax, and some audits actually result in refunds.) So the folks in the Small Business/Self-Employed area have compiled a series of Audit Technique Guides to help examiners with insight into issues and accounting methods unique to specific industries. As the IRS explains, "ATGs explain industry-specific examination techniques and include common, as well as unique, industry issues, business practices and terminology. Guidance is also provided on the examination of income, interview techniques and evaluation of evidence."

it comes to audits, our friends at the IRS are interested in examining returns as accurately as possible. (No, they're not just interested in squeezing out more tax, and some audits actually result in refunds.) So the folks in the Small Business/Self-Employed area have compiled a series of Audit Technique Guides to help examiners with insight into issues and accounting methods unique to specific industries. As the IRS explains, "ATGs explain industry-specific examination techniques and include common, as well as unique, industry issues, business practices and terminology. Guidance is also provided on the examination of income, interview techniques and evaluation of evidence." it comes to audits, our friends at the IRS are interested in examining returns as accurately as possible. (No, they're not just interested in squeezing out more tax, and some audits actually result in refunds.) So the folks in the Small Business/Self-Employed area have compiled a series of Audit Technique Guides to help examiners with insight into issues and accounting methods unique to specific industries. As the IRS explains, "ATGs explain industry-specific examination techniques and include common, as well as unique, industry issues, business practices and terminology. Guidance is also provided on the examination of income, interview techniques and evaluation of evidence."

it comes to audits, our friends at the IRS are interested in examining returns as accurately as possible. (No, they're not just interested in squeezing out more tax, and some audits actually result in refunds.) So the folks in the Small Business/Self-Employed area have compiled a series of Audit Technique Guides to help examiners with insight into issues and accounting methods unique to specific industries. As the IRS explains, "ATGs explain industry-specific examination techniques and include common, as well as unique, industry issues, business practices and terminology. Guidance is also provided on the examination of income, interview techniques and evaluation of evidence."