As all of use hurtle down the road toward the implementation of the 2010 health care legislation it sure does appear that the health care legislation will certainly create its own health problems... especially for your tax adviser! There is a lot to know about the 2010 health care legislation in order to take advantage of favorable provisions and to avoid or minimize penalties.

As all of use hurtle down the road toward the implementation of the 2010 health care legislation it sure does appear that the health care legislation will certainly create its own health problems... especially for your tax adviser! There is a lot to know about the 2010 health care legislation in order to take advantage of favorable provisions and to avoid or minimize penalties.

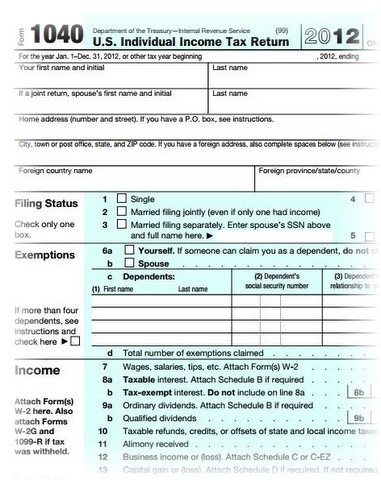

The health care legislation enacted in March 2010—the Patient Protection and Affordable Care Act (PPACA), P.L. 111-148, as amended by the Health Care and Education Reconciliation Act, P.L.111-152—is almost 1,000 pages long. It involves numerous rules on employer-provided health care, insurance exchanges, insured rights, and the health care delivery system. There are numerous tax provisions. Guidance from the IRS and other government agencies has been emerging since 2010, and much of it is quite lengthy.

The Affordable Care Act includes a variety of measures specifically for small businesses that help lower premium cost growth and increase access to quality, affordable health insurance. Depending on whether