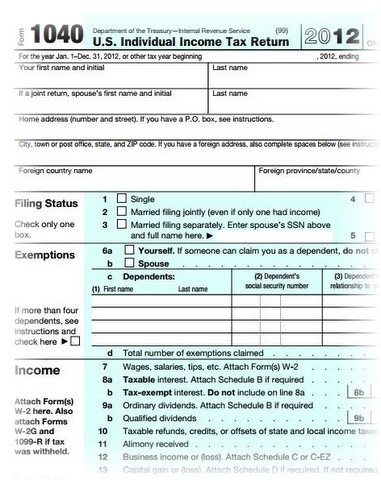

Today's tight economy is forcing governments at every level to stretch for new revenue, with varying degrees of success. In Washington, the dysfunctional family known as "Congress" just raised the top income tax rate to 39.6%, and there are new taxes on earned income and investment income as well. But when President Obama proposed cutting loopholes to raise even more money as an alternative to the budget sequester, his idea was met mostly with scorn.

tight economy is forcing governments at every level to stretch for new revenue, with varying degrees of success. In Washington, the dysfunctional family known as "Congress" just raised the top income tax rate to 39.6%, and there are new taxes on earned income and investment income as well. But when President Obama proposed cutting loopholes to raise even more money as an alternative to the budget sequester, his idea was met mostly with scorn.

Most state governments are in fiscal hot water, too. But Illinois may be worst off of all. Nearly $100 billion in unfunded pension liability is crushing the state budget. Last week, the bond ratings agency Standard & Poor's downgraded the Land of Lincoln's score to last in the nation. Ratings rival Moodys ranks Illinois at the same level as the