Television's late-night hosts have entertained us since Steve Allen first took the mic on The Tonight Show back in 1954. Today's late-night monologues riff on serious topics like international politics and economic policy, and silly topics like the "Real Housewives of Lima, Ohio." Naturally, they've also weighed in on our friends at the IRS. So this week, we present some of our favorite tax wisecracks from late-night television:

Television's late-night hosts have entertained us since Steve Allen first took the mic on The Tonight Show back in 1954. Today's late-night monologues riff on serious topics like international politics and economic policy, and silly topics like the "Real Housewives of Lima, Ohio." Naturally, they've also weighed in on our friends at the IRS. So this week, we present some of our favorite tax wisecracks from late-night television:

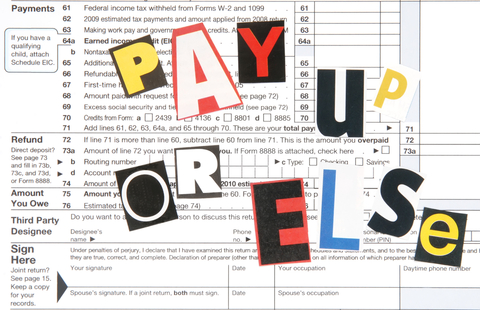

"65% of people say that cheating on your income tax is worse than cheating on your spouse. The other 35% were women." (Jay Leno)