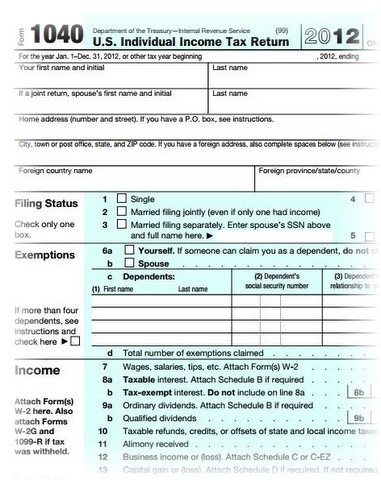

"Tax season" as we all know it is an American tradition. For a few months at the beginning of each year everyone is scrambling to find receipts, W-2 forms, mortgage interest, business profits, etc. so that they can get to their tax accountant and find out the good or not-so-good news about their tax bill.

"Tax season" as we all know it is an American tradition. For a few months at the beginning of each year everyone is scrambling to find receipts, W-2 forms, mortgage interest, business profits, etc. so that they can get to their tax accountant and find out the good or not-so-good news about their tax bill.

Most years there is a practical window of about 10 weeks to get all this accomplished, from the first week of February through April 15 (remember, most of us don't even receive all our paperwork from third parties until the end of January). For me as a CPA, this is my claimed reason for my current hair style, or to be more candid, lack of hair much at all. I've chosen to let my genetics off the hook for this one.

In early January, the IRS announced a delayed, Jan. 30, start to the 2013 tax filing season, and it did not start accepting business tax returns until Feb. 4. The IRS also announced that, because of the need for extensive form and processing systems changes, many taxpayers would not be able to file returns until March -- and when in March we still do not know.